The Sloan Market

The Sloan Market is a term that has been gaining traction in the business world, particularly among investors, analysts, and economists. Understanding this market’s nuances is essential for anyone looking to capitalize on its opportunities or simply stay informed about its trends. This comprehensive guide aims to provide an in-depth look at the Sloan Market, exploring its fundamentals, trends, opportunities, and key players.

To read more about marketing check out here

What is the Sloan Market?

The Sloan Market refers to a specialized segment within the broader financial markets that focuses on a particular set of investment opportunities and trading activities. Named after the Sloan School of Management at MIT, which is renowned for its research in financial markets and management practices, the Sloan Market embodies the innovative and strategic approaches that characterize the school’s influence.

In essence, the Sloan Market represents an area where advanced financial models, strategic investment methodologies, and cutting-edge technology intersect. It includes various asset classes, from equities and bonds to alternative investments and digital assets, each offering unique opportunities and risks.

Historical Context and Evolution

Understanding the Sloan Market requires a historical perspective. The concept began to take shape in the late 20th century as financial theories and technologies evolved. Initially, it was more academic, rooted in research and theories developed at MIT. However, as these theories were tested and refined, they began to influence real-world financial practices.

1980s-1990s: Academic Beginnings

In the 1980s and 1990s, the Sloan Market was largely an academic concept. Researchers at MIT Sloan School of Management, led by prominent figures like Fischer Black and Robert Merton, developed models that revolutionized our understanding of financial markets. Their work on option pricing and risk management laid the groundwork for many modern trading strategies.

2000s-Present: Practical Application and Growth

The turn of the millennium saw these academic theories become practical tools for investors. The Sloan Market began to attract attention from institutional investors and hedge funds, who used advanced models to gain a competitive edge. With the advent of high-frequency trading and algorithmic strategies, the Sloan Market expanded its influence, becoming a significant player in global financial markets.

Key Components of the Sloan Market

The Sloan Market is characterized by several key components, each contributing to its complexity and dynamism. Understanding these components is crucial for navigating the market effectively.

1. Advanced Financial Models

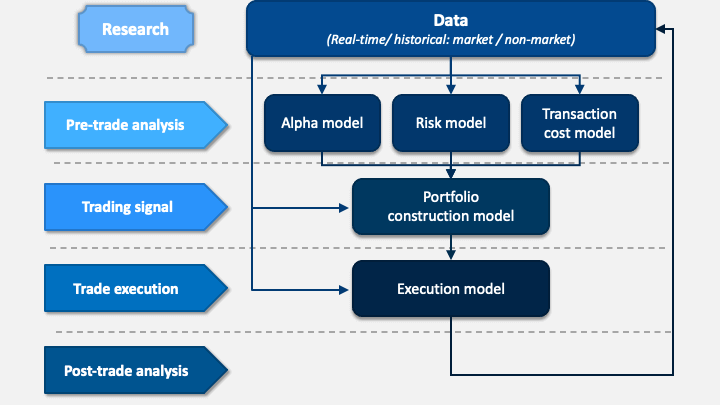

Central to the Sloan Market are advanced financial models that drive investment strategies. These models include:

- Option Pricing Models: These models, including the Black-Scholes model, are used to determine the fair value of options and derivatives.

- Risk Management Frameworks: Techniques such as Value at Risk (VaR) and Conditional Value at Risk (CVaR) help in assessing and managing financial risks.

- Quantitative Analysis: This involves using statistical methods and algorithms to identify trading opportunities and predict market movements.

2. Strategic Investment Methodologies

Investment strategies within the Sloan Market are designed to leverage advanced models and technologies. These methodologies include:

- Algorithmic Trading: This involves using algorithms to execute trades at optimal prices and speeds.

- Quantitative Investing: Investors use quantitative models to make data-driven investment decisions.

- Arbitrage Strategies: These strategies exploit price discrepancies between different markets or assets.

3. Technological Integration

Technology plays a vital role in the Sloan Market. Key technological advancements include:

- High-Frequency Trading: Utilizing algorithms to execute a large number of trades within fractions of a second.

- Blockchain and Digital Assets: Blockchain technology and cryptocurrencies are becoming increasingly important in modern financial markets.

- Artificial Intelligence: AI and machine learning are used to analyze vast amounts of data and enhance trading strategies.

Key Players in the Sloan Market

Several key players influence the Sloan Market, each contributing to its dynamics and growth. These include:

1. Institutional Investors

Institutional investors, such as hedge funds and mutual funds, are significant players in the Sloan Market. They use advanced financial models and strategies to manage large portfolios and drive market trends.

2. Technology Providers

Companies that provide trading technology, data analytics, and financial software are crucial to the Sloan Market. These technology providers enable investors to implement sophisticated strategies and improve trading efficiency.

3. Academic and Research Institutions

Institutions like MIT Sloan School of Management continue to play a pivotal role in advancing financial theories and models. Their research shapes the strategies and tools used in the Sloan Market.

Trends and Opportunities in the Sloan Market

The Sloan Market is dynamic and continually evolving. Several trends and opportunities are currently shaping its landscape:

1. Rise of Quantitative and Algorithmic Trading

Quantitative and algorithmic trading have become dominant forces in the Sloan Market. These methods offer the potential for significant returns but also come with risks. Investors must stay abreast of the latest algorithms and models to remain competitive.

2. Growth of Digital Assets and Blockchain Technology

Digital assets, including cryptocurrencies and blockchain-based financial products, are gaining prominence. Blockchain technology’s potential to disrupt traditional financial systems offers new opportunities for innovation and investment.

3. Increased Focus on ESG Investing

Environmental, Social, and Governance (ESG) investing is becoming increasingly important. Investors are looking for opportunities that align with their values and contribute to sustainable development.

Challenges and Risks

While the Sloan Market offers numerous opportunities, it also presents several challenges and risks:

1. Market Volatility

The Sloan Market can be highly volatile, especially with the use of advanced trading algorithms. Investors must be prepared for rapid changes and potential losses.

2. Regulatory Changes

Regulatory changes can impact the Sloan Market significantly. Keeping up with evolving regulations and ensuring compliance is crucial for market participants.

3. Technological Risks

With the increasing reliance on technology, there are risks associated with cybersecurity and system failures. Investors must ensure robust security measures and contingency plans.

Navigating the Sloan Market: Tips and Strategies

Successfully navigating the Sloan Market requires a strategic approach and a thorough understanding of its components. Here are some tips and strategies to consider:

1. Stay Informed and Educated

Continuous learning and staying updated with the latest research and developments are essential. Follow academic journals, attend industry conferences, and engage with thought leaders.

2. Leverage Technology and Data

Utilize advanced technology and data analytics to enhance your investment strategies. Invest in tools that provide real-time data and support quantitative analysis.

3. Diversify Your Investments

Diversification can help manage risk and optimize returns. Explore various asset classes and investment strategies to build a balanced portfolio.

4. Monitor Regulatory Changes

Keep abreast of regulatory developments that may impact the Sloan Market. Ensure that your strategies comply with current regulations and adapt to any changes.

Conclusion

The Sloan Market represents a fascinating intersection of advanced financial models, strategic investment methodologies, and cutting-edge technology. As it continues to evolve, understanding its components, trends, and key players is crucial for anyone looking to engage with this dynamic sector. By staying informed, leveraging technology, and employing strategic investment approaches, you can navigate the Sloan Market effectively and seize its opportunities.

The Sloan Market’s complexity and rapid evolution present both challenges and opportunities. Whether you are an investor, analyst, or simply an enthusiast, keeping up with its developments will ensure that you remain at the forefront of this exciting and ever-changing field.