Introduction

Understanding AAPL Pre-Market Activity: A Comprehensive Guide |2024|

Understanding AAPL Pre-Market Activity

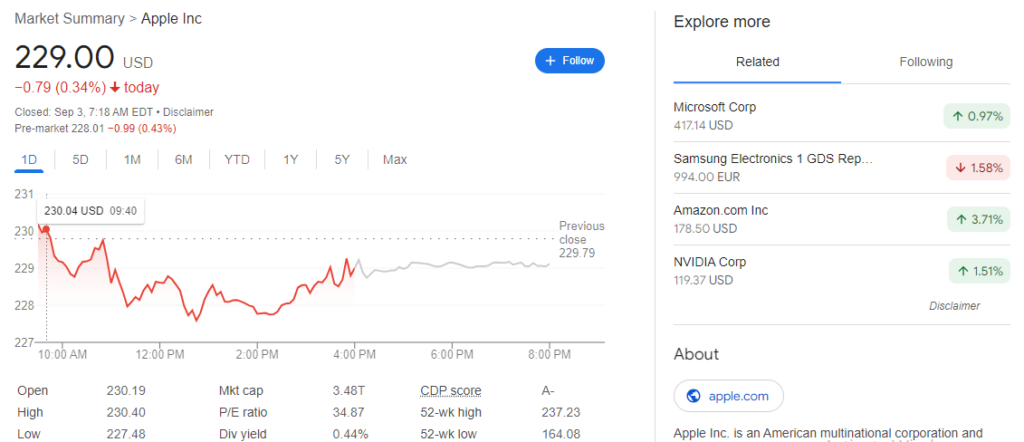

When it comes to trading stocks, especially high-profile companies like Apple Inc. (AAPL), understanding pre-market activity is crucial. For investors and traders alike, AAPL pre-market movements can offer significant insights into how the stock might perform during regular trading hours. In this comprehensive guide, we will delve into what pre-market trading is, how it affects AAPL, and strategies for leveraging this information. This article aims to be a definitive resource for anyone looking to grasp the nuances of AAPL pre-market trading.

What is Pre-Market Trading?

Pre-market trading refers to the buying and selling of stocks before the official market opening hours of 9:30 AM to 4:00 PM Eastern Time. The pre-market session typically runs from 4:00 AM to 9:30 AM Eastern Time. This trading period allows investors to react to news, earnings reports, and other significant events before the regular trading day begins.

How Does Pre-Market Trading Affect AAPL?

Apple Inc. (AAPL) is one of the most watched stocks in the market due to its massive market capitalization and influence in the technology sector. Pre-market trading can significantly impact AAPL’s stock price for several reasons:

- Earnings Reports: Apple’s quarterly earnings reports are highly anticipated events. Positive or negative surprises can lead to sharp pre-market movements.

- News and Announcements: Any news related to Apple, whether it’s about new product releases, management changes, or regulatory issues, can cause pre-market volatility.

- Global Events: Geopolitical events or economic data releases can influence AAPL’s pre-market performance due to their broader impact on market sentiment.

- Institutional Activity: Large institutional investors often conduct trades in the pre-market session, which can set the tone for AAPL’s performance once the market opens.

Key Factors Influencing AAPL Pre-Market Trading

- Earnings Reports and Guidance:

- Earnings Surprises: When AAPL reports earnings that are significantly above or below analyst expectations, the stock may experience significant pre-market movement.

- Forward Guidance: Apple’s guidance for future performance can also impact investor sentiment and pre-market trading activity.

- News Releases:

- Product Launches: Announcements of new products or services can lead to pre-market price changes as traders react to potential future revenues.

- Regulatory News: News about potential regulations or legal issues can also affect pre-market trading.

- Economic Data:

- Consumer Confidence Reports: As a major consumer brand, AAPL can be influenced by data on consumer confidence and spending.

- Interest Rate Changes: Decisions by the Federal Reserve regarding interest rates can impact AAPL’s stock price, especially if they affect consumer spending or borrowing costs.

- Global Market Trends:

- International Markets: Apple’s global presence means that economic conditions or market movements in other countries can influence pre-market trading.

- Geopolitical Events: Events such as trade tensions or international conflicts can lead to pre-market volatility.

How to Analyze AAPL Pre-Market Data

Analyzing AAPL pre-market data involves several steps:

- Monitor Pre-Market Prices:

- Check pre-market price quotes from reliable financial news websites or trading platforms to gauge initial investor sentiment.

- Evaluate News and Reports:

- Stay updated with news releases, earnings reports, and any other relevant announcements that might affect AAPL.

- Compare Historical Pre-Market Movements:

- Look at historical data to understand how AAPL has reacted to similar news or events in the past.

- Consider Volume:

- Analyze pre-market trading volume, as high volume can indicate strong investor interest and potentially more significant price movement.

Strategies for Trading AAPL in Pre-Market

- Pre-Market Analysis:

- Conduct thorough research before the market opens. This includes reviewing news, earnings reports, and global economic conditions.

- Set Pre-Market Alerts:

- Use trading platforms that allow you to set alerts for significant price movements or news related to AAPL.

- Risk Management:

- Given the volatility of pre-market trading, implement strict risk management practices. Use stop-loss orders to protect your investments.

- Stay Informed:

- Continuously monitor updates from financial news sources and adjust your strategies based on new information.

Common Mistakes in Pre-Market Trading

- Overreacting to News:

- Traders often overreact to news without fully understanding its implications. It’s essential to analyze the news contextually.

- Ignoring Pre-Market Volume:

- Low volume in pre-market trading can lead to more significant price swings. Be cautious when trading with low volume.

- Lack of Risk Management:

- Failing to set stop-loss orders or proper risk management strategies can result in significant losses.

- Neglecting to Compare Historical Data:

- Not considering historical pre-market data can lead to poor decision-making. Always compare current movements with historical trends.

Case Study: AAPL’s Pre-Market Performance During Major Events

- Earnings Report Surprises:

- In instances where Apple has exceeded earnings expectations, such as in the Q1 2024 earnings report, AAPL’s pre-market price often shows significant movement.

- Product Launches:

- The announcement of the iPhone 15, for example, led to increased pre-market activity as investors anticipated a boost in sales.

- Economic Conditions:

- During periods of economic uncertainty, such as the COVID-19 pandemic, AAPL’s pre-market activity reflected broader market concerns and investor sentiment.

Conclusion

Understanding AAPL pre-market trading can provide valuable insights and opportunities for investors and traders. By analyzing pre-market data, staying informed about news and economic conditions, and applying effective trading strategies, you can make more informed decisions regarding AAPL stock. Remember to conduct thorough research, manage your risks carefully, and continuously monitor market conditions.

For anyone serious about trading AAPL or any other high-profile stock, mastering the nuances of pre-market trading is an essential skill. By incorporating the strategies and tips outlined in this guide, you can enhance your trading effectiveness and better navigate the complexities of the financial markets.

Additional Resources

- Financial News Websites:

- Stay updated with reputable financial news sources for the latest information on AAPL and other market trends.

- Trading Platforms:

- Utilize advanced trading platforms that offer pre-market data, alerts, and analysis tools.

- Educational Material:

- Invest in educational resources to further your understanding of pre-market trading and market analysis.