Introduction

In the ever-evolving world of technology and finance, few stocks capture the public’s imagination quite like APPL stock. Known formally as Apple Inc. (AAPL), this stock is a key player in the market, symbolizing innovation and economic strength. This article provides a comprehensive analysis of APPL stock, examining its performance, market trends, and future outlook. Whether you’re a seasoned investor or new to the stock market, understanding APPL stock is crucial for making informed investment decisions.

What is APPL Stock?

APPL stock refers to the shares of Apple Inc., one of the most valuable and influential technology companies globally. Founded in 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple Inc. has grown from a small startup to a tech giant, producing popular products like the iPhone, iPad, Mac computers, and various other innovative technologies. Its stock is traded on the NASDAQ under the ticker symbol “AAPL.”

Historical Background

Apple’s journey in the stock market began in 1980 with an initial public offering (IPO) that raised $100 million. Over the decades, APPL stock has seen significant growth, driven by technological advancements, successful product launches, and strategic business decisions.

Key Factors Influencing APPL Stock

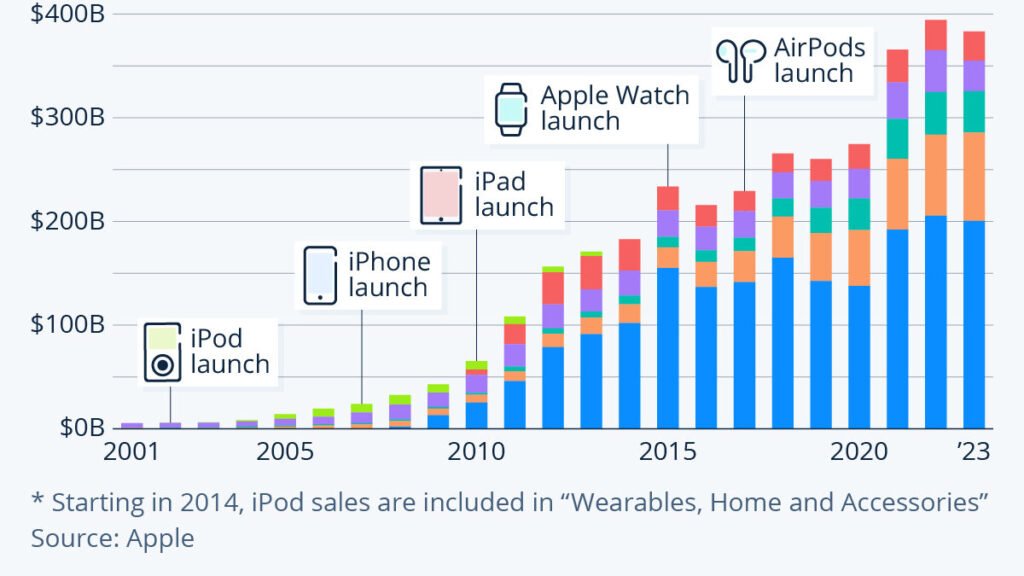

1. Product Innovation

Apple is renowned for its commitment to innovation. Each new product release often leads to substantial fluctuations in APPL stock price. The introduction of groundbreaking products like the iPhone, iPad, and Apple Watch has consistently boosted investor confidence and stock performance.

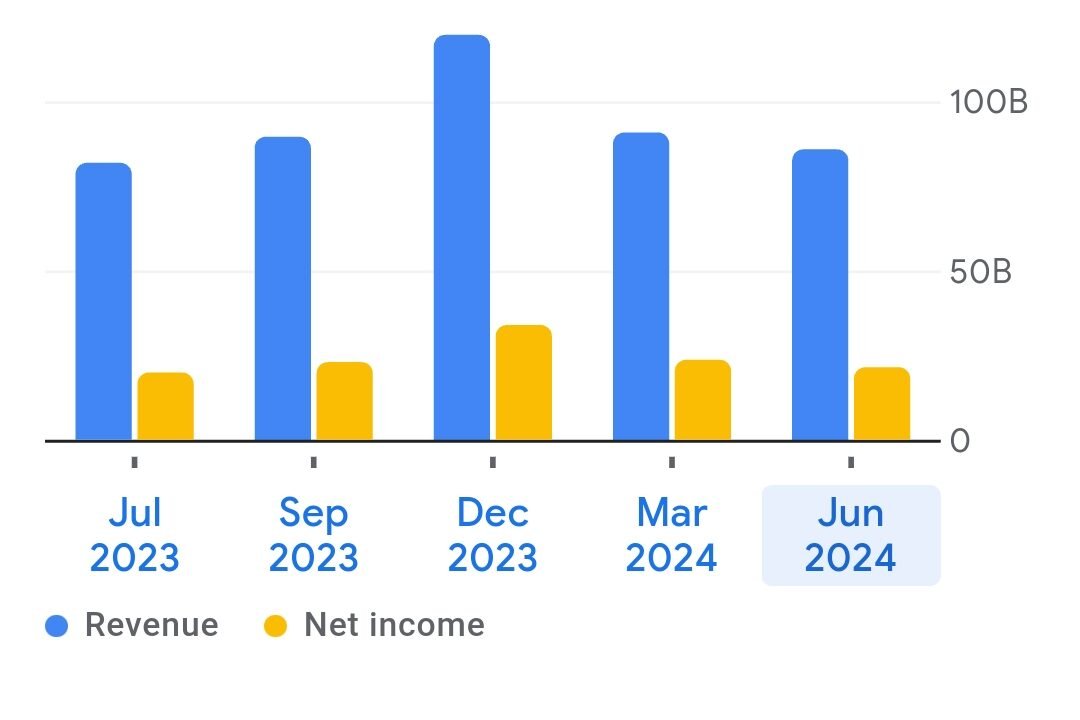

2. Financial Performance

Apple’s financial health is a crucial factor influencing APPL stock. Investors closely monitor the company’s quarterly earnings reports, revenue growth, profit margins, and overall financial stability. Strong financial performance typically results in a positive impact on the stock price.

3. Market Trends

The technology sector is highly dynamic, and market trends significantly affect APPL stock. Factors such as technological advancements, consumer preferences, and global economic conditions play a role in determining the stock’s performance. Staying updated on market trends can help investors make informed decisions about APPL stock.

4. Competitive Landscape

Apple operates in a highly competitive industry. Competitors like Microsoft, Google, and Samsung continually strive to capture market share. Changes in the competitive landscape can impact APPL stock, as investors assess how well Apple can maintain its market position and adapt to new challenges.

5. Global Economic Conditions

Global economic conditions, including interest rates, inflation, and geopolitical events, can influence APPL stock. Economic downturns or uncertainties can lead to market volatility, affecting stock prices across various sectors, including technology.

Analyzing APPL Stock Performance

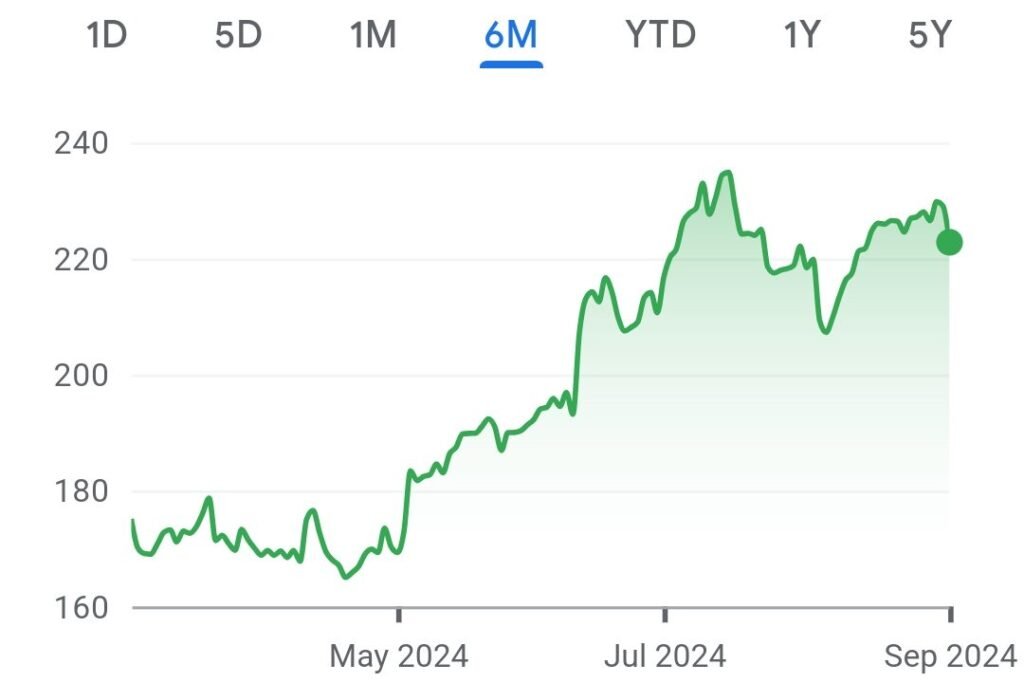

Recent Trends

To understand APPL stock’s recent performance, it’s essential to analyze its stock price trends, trading volume, and market capitalization. Over the past year, APPL stock has experienced periods of growth and volatility. Understanding these trends can provide insights into future performance.

Technical Analysis

Technical analysis involves studying historical price data and trading volumes to predict future stock movements. Key technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands are used to assess APPL stock’s potential.

Fundamental Analysis

Fundamental analysis focuses on evaluating Apple’s financial health and overall business performance. Key metrics include the price-to-earnings (P/E) ratio, earnings per share (EPS), and revenue growth. A strong financial foundation often translates to a more robust stock performance.

Future Outlook for APPL Stock

Growth Prospects

Apple’s growth prospects are driven by its ability to innovate and expand into new markets. Upcoming product releases, advancements in technology, and strategic partnerships play a role in shaping the future outlook for APPL stock. Investors should keep an eye on the company’s plans for new product lines and market expansion.

Risks and Challenges

While APPL stock has historically performed well, it is not without risks. Potential challenges include supply chain disruptions, regulatory changes, and shifts in consumer preferences. Assessing these risks is crucial for understanding the potential impact on APPL stock’s performance.

Investment Strategies

Investors considering APPL stock should develop strategies based on their financial goals and risk tolerance. Common strategies include long-term investing, dividend reinvestment plans (DRIPs), and diversification to manage risk. Analyzing historical performance and market conditions can help formulate effective investment strategies.

Conclusion

APPL stock remains a pivotal component of the technology sector, reflecting Apple Inc.’s ongoing innovation and market influence. Understanding the factors that drive APPL stock, analyzing its performance, and considering future outlooks can provide valuable insights for investors. As Apple continues to evolve and adapt to market conditions, staying informed about APPL stock will be essential for making sound investment decisions.