Introduction

In the ever-evolving world of finance, the term “bolla market” has garnered increasing attention from investors, analysts, and financial enthusiasts alike. This concept, though less commonly discussed than its more famous counterpart, the “bull market,” offers unique insights into market dynamics and investor behavior. In this comprehensive guide, we will delve into the intricacies of the bolla market, its characteristics, historical examples, and strategies for navigating it. By understanding the nuances of the bolla market, you can make more informed investment decisions and better position yourself in the financial landscape.

The term “bolla market” is derived from a variation of the term “bubble market,” reflecting a market condition where asset prices are inflated beyond their intrinsic value. Unlike a bull market, which is characterized by rising prices and investor optimism, a bolla market is marked by unsustainable price increases driven by speculative behavior. Investors in a bolla market may experience a rapid surge in asset values, followed by a sharp decline when the bubble bursts.

Characteristics of a Bolla Market

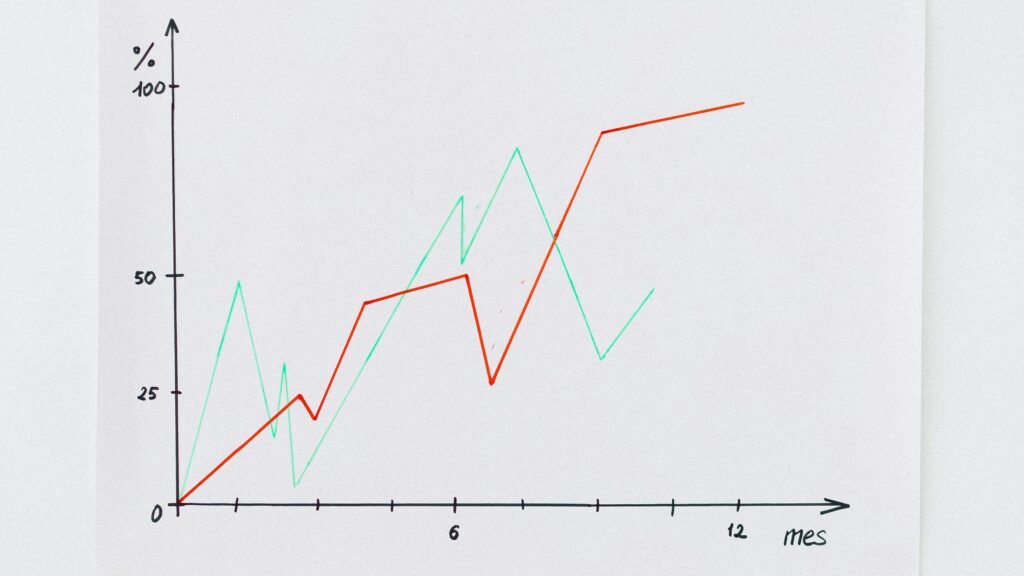

- Rapid Price Appreciation: In a bolla market, asset prices tend to rise at an accelerated pace, often fueled by speculative buying rather than fundamental value. This rapid appreciation can create an illusion of sustained profitability.

- Increased Speculation: Investors in a bolla market are often driven by the fear of missing out (FOMO) and engage in speculative trading. This behavior further inflates asset prices, creating a self-reinforcing cycle.

- Lack of Fundamental Support: Unlike in a bull market, where price increases are typically supported by strong economic fundamentals, a bolla market lacks such backing. Instead, asset prices may diverge significantly from their intrinsic value.

- Volatility and Uncertainty: A bolla market is characterized by high volatility and uncertainty. The rapid rise and fall in asset prices can lead to significant market swings and investor panic.

Historical Examples of Bolla Markets

- The Dot-Com Bubble (1997-2000): One of the most well-known examples of a bolla market is the dot-com bubble. During this period, technology stocks, particularly those related to the internet, saw unprecedented price increases. Investors poured money into tech companies with little regard for their actual earnings or business models. The bubble burst in 2000, leading to a dramatic decline in tech stock prices.

- The Housing Bubble (2000s): The U.S. housing market experienced a bolla market in the mid-2000s, driven by speculative buying and lax lending practices. Home prices soared to unsustainable levels, leading to the subprime mortgage crisis and the subsequent financial crash of 2008.

- Cryptocurrency Boom (2017-2018): The cryptocurrency market, particularly Bitcoin, witnessed a bolla market in late 2017. Prices of cryptocurrencies skyrocketed as speculative interest surged. However, the bubble burst in early 2018, resulting in a significant price correction.

Identifying a Bolla Market

Recognizing a bolla market can be challenging, as it often involves a combination of subjective and objective factors. Here are some indicators to watch for:

- Extreme Valuations: Look for assets that are trading at valuations significantly higher than their historical averages or intrinsic value.

- Excessive Speculation: Pay attention to market sentiment and trading behavior. High levels of speculation and media hype can be red flags.

- Market Euphoria: Observe investor sentiment. A general sense of euphoria and overconfidence can indicate a bolla market.

- Disconnection from Fundamentals: Analyze whether asset prices are supported by strong financial fundamentals or if they are driven solely by speculative interest.

Strategies for Navigating a Bolla Market

- Diversification: Diversify your investment portfolio to mitigate risk. In a bolla market, spreading investments across different asset classes can help protect against significant losses.

- Risk Management: Implement risk management strategies such as setting stop-loss orders and maintaining a conservative allocation to high-risk assets.

- Due Diligence: Conduct thorough research and due diligence before making investment decisions. Focus on assets with strong fundamentals rather than succumbing to market hype.

- Avoid FOMO: Resist the urge to chase after rapidly appreciating assets. Making investment decisions based on fear of missing out can lead to poor outcomes.

- Stay Informed: Keep abreast of market trends and developments. Staying informed will help you make timely and well-informed investment decisions.

The Impact of a Bolla Market on Investors

A bolla market can have a profound impact on investors, both psychologically and financially. Here are some key effects:

- Emotional Stress: The volatility and uncertainty associated with a bolla market can lead to increased emotional stress for investors. Managing emotions and maintaining a long-term perspective is crucial.

- Financial Losses: If the bubble bursts, investors who have heavily invested in overvalued assets may face substantial financial losses. Proper risk management and diversification can help mitigate these risks.

- Market Timing Challenges: Timing the market can be particularly challenging in a bolla market. Investors may find it difficult to predict when the bubble will burst and adjust their strategies accordingly.

- Opportunity Costs: While invested in a bolla market, investors may miss out on other investment opportunities that offer better risk-return profiles.

Lessons Learned from Past Bolla Markets

Examining past bolla markets provides valuable lessons for current and future investors. Key takeaways include:

- Be Wary of Hype: Financial markets can be driven by hype and speculation. Always conduct independent research and avoid making investment decisions based solely on market sentiment.

- Focus on Fundamentals: Invest in assets with strong fundamental values rather than chasing after speculative trends. Fundamental analysis provides a more reliable basis for investment decisions.

- Maintain a Long-Term Perspective: Avoid short-term thinking and maintain a long-term investment perspective. While a bolla market may present opportunities, focusing on long-term goals can help mitigate risks.

- Prepare for Market Corrections: Be prepared for potential market corrections and adjust your investment strategy accordingly. Understanding that markets go through cycles can help you navigate challenging periods more effectively.

Conclusion

The concept of the bolla market offers a critical perspective on market dynamics and investor behavior. By understanding its characteristics, historical examples, and impact on investors, you can better navigate the complexities of financial markets. Implementing effective strategies and learning from past experiences can help you make more informed investment decisions and manage risks effectively.

As you continue to explore the world of investing, remember that markets are inherently cyclical, and being prepared for different market conditions is key to long-term success. Stay informed, conduct thorough research, and always prioritize sound investment principles.